-

How To Save Money With Stock Trading Programs For Mac카테고리 없음 2020. 1. 30. 20:28

Updated April 2018 You’re looking for a new stock trading computer but you aren’t sure where to start well you’ve come to the right place. The majority of people just go buy a computer off the shelf and use it for trading, or they for a “Trading Computer”, there is another option. Build your own! With a little bit of research you can quite easily build you own trading computer or upgrade a computer you already have to meet your needs for trading. In this guide I will walk you through each of the different components in a system and help give you some guidance as to what you should choose when putting together your own system. The Components CPU/Processor Which processor you choose will basically dictate the rest of your system and the hardware you will need.

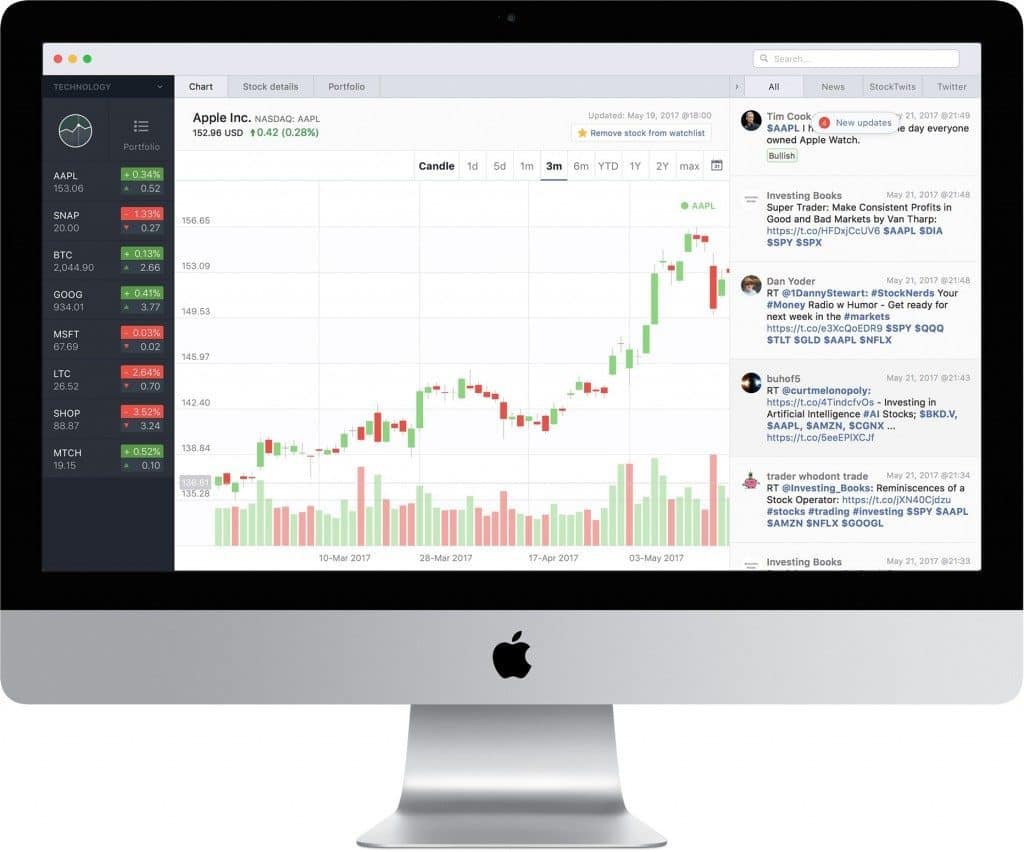

The mobile trading experience varies by broker, ranging from an app that mimics the desktop experience to purposefully simple — and so do the range of available assets. With these Stock Trading Programs, you can trade directly from the charts with broker integration The Best Stock Trading Software for Beginners TradingView – so easy to use and with an intuitive design, TradingView is absolutely ideal for beginners & has a strong social community. Most stock trading software on Mac is for tracking stock market tand forex rends only. There isn't any multi-asset software that includes options and bonds as well on Mac. As regards actual trading software, this article on the Best Stock Trading Software For Mac covers pretty much everything out.

For stock trading, most people just need a good processor, there is no need to go all out and purchase a bleeding edge, top of the line, gaming processor. That will just be overkill and you’ll be flushing money down the drain. Personally, I would look at a middle of the line Intel Core i7 processor. They have 6 cores and are plenty fast to handle any trading needs you throw at it. If those are out of your budget then look at a top of the line Intel Core i5. You’ll save a bit of money, but also sacrifice some performance. The processor is the single hardest thing in a system to upgrade so I would suggest spending more money here if possible.

My recommendation: Motherboard Which motherboard you are going to use is going to be dictated by 3 things:. The processor you choose. The size case you choose.

The number of video cards you want to run. The processor we chose above has a socket type called LGA 1151, basically that means that the connector, or socket, that the processor needs to connect to the motherboard is an LGA 1151 connector. That will be the biggest factor in picking out a motherboard. The second step is to determine the size board you need.

If you are building some monstrous gaming system and want a million different connectors and port options, then you’ll want a Full ATX or Extended ATX board. However, that’s probably way overkill. Personally, I build about 90% of my computers with the microATX form factor. There are smaller options as well, however microATX has about the best combination of size while still having enough ports. It’s also the most popular form factor.

The only other thing to take into consideration at this point is how many video cards you are looking to run. You may be able to save yourself some money by purchasing cheaper video cards that may only run 2 monitors at a time but then purchase more of those cards, say two or three of them, to run up to four or six monitors. If that is the case then you will need to look for a motherboard with the correct number of video card ports (PCI Express 3.0 x16). Finding a board with two or three of these ports/slots is not difficult, it’s just something that needs to be thought about now as it’s not possible to add more down the road.

With all of these options I am going to recommend a board that has an LGA 1151 chipset to match our processor, is a microATX form factor, and has two PCI Express 3.0 x16 ports. The board also supports m.2 hard drives, some of the fastest drives available. My recommendation: Memory/RAM Now that we have our processor and motherboard picked out we can choose which RAM (Random Access Memory) we want to use. The motherboard we chose can handle up to 64GB of DDR4 2666 memory. Memory is where any open applications are stored while you are running them.

For trading I would say 8GB would be the bare minimum I would run, but 16GB would be much better. For this system I am going to choose tw0 8GB DDR4 2666 modules. Because this motherboard has four memory slots this will allow us to easily add two more memory modules down the road. My recommendation: Hard Drive The hard drive is where all of your information is stored-operating system, programs, data, pictures, music, everything. For stock trading “everything” really isn’t that much information. Your operating system with a few trading platforms really does not take up that much room so we don’t need a huge hard drive for trading.

There are basically two types of hard drives, the old magnetic/spinning platter based drives and the new flash based drives, or SSDs. With the older type of drives you can get tons of storage for a very small price, but you have to sacrifice speed. SSD’s are extremely fast but cost much more per GB of storage. Because we do not need a lot of storage space for trading a decent sized SSD is our best option. If down the road we do need more storage space, we could add an additional magnetic drive and use that to store things like pictures and videos. My recommendation: Video Card In trading, pretty much the only things that matter here are:. How many monitors do you want to run?.

What video ports do those monitors have?. How many video card slots (PCI Express x16) do you have on your motherboard? For this example, we are going to say we want to run 4 monitors. We have yet to purchase the monitors so the ports are flexible, and the motherboard we purchased has two PCI Express x16 slots.

At this point we have two options: we can either purchase a video card that has 4 ports on it and only uses 1 of the video card slots, or we can purchase two cheaper video cards and use up both slots. This will really come down to personal preference and if you think you will want to expand to more monitors down the road, as well as which video ports you would like to use. Personally, I purchase all of my video cards and monitors to connect via the DisplayPort connector. While slightly more expensive, DisplayPort gives you the largest amount of options and flexibility. I also prefer to go with workstation class video cards over consumer/gaming video cards.

Workstation cards are designed to be run all day every day while remaining cool and quiet. They will keep the overall noise level of your system down. My video card recommendation: Case The computer case you choose is almost 100% personal preference, so long as the case is large enough to hold whichever motherboard you chose, the rest is all up to what you like or don’t like.

My recommendation: Power Supply You will also need a power supply to power all of your components in your system. Really here we just need to match up our components and case and make sure that the power supply has all the necessary connections and will fit in the case. We have a standard size ATX case, so that’s not an issue, and all of our ports on our system are standard too with a 24 pin power connector and 8 pin CPU connector.

The only other thing you need to be concerned about is that some larger video cards need an additional power connection so make sure you check the specs on whichever video card you have chosen to see what it needs. My recommendation: Monitors Monitors will once again be pretty much all personal preference. Because we chose video cards with DisplayPort connectors, I’d look for monitors with DisplayPort as well. 27” is a great size, its big enough while not being overly huge. For a resolution I’d strongly recommend going with a 4k (3840 x 2160) monitor. Basically, the resolution is how much information you can fit on the screen at one time. The larger those numbers, the denser the pixels are in the display, and the more information you can fit on the screen.

How To Save Money With Stock Trading Programs For Machines

My recommendation: Monitor Stands Typically, the stands that come with monitors are not tall enough to support a good ergonomic position while using them. If you are looking to trade full time you need to take care of your body and need to get your desk setup to not damage your body and posture.

Also once you start getting more than one or two monitors, the built in stands can start to take up a lot of room. If you’re looking for a high quality stand check out the Loctek D7 series or stands.

They come in, and monitor configurations. Operating System By far the most popular operating system is Microsoft Windows. If you are building your own system, you can either choose Windows or Linux. If you are someone who would choose Linux you’re already very tech savvy and probably aren’t reading this article!

Not to mention pretty much every trading platform out there will support Windows. My recommendation: Input Devices Once again these are all up to your preference but this is what I use:. Web Cam:. Keyboard and Mouse:. Podcast Microphone: Battery Backup I also have my computer, monitors, modem, and router connected to a battery backup, in the event the power goes out while I am trading I will still have time to close out of my position before I completely lose power. My recommendation: Conclusion At the time of this writing, the system I just laid out for you, not including monitors or any other peripherals, would cost you just over $1000.

A system like this would easily handle just about any trading task you throw at it, and would cost you almost twice as much if you were to buy it from a Trading Computer Seller. If you are interested in building a trading computer I’d strongly recommend you check out. They have a great system for helping you pick out components that will work together as well as showing you the best price for each part.

They also offer a ton of guides and walk through videos explaining how to assemble a computer system. If you have any further questions or comments, please leave them in the comment section below or use the contact button on this page.

. Credit Cards. Best of. Compare cards. Reviews.

Read & learn. Banking.

Best of. Compare accounts.

Reviews. Read & learn.

Investing. Best of. Reviews.

Popular tools. Guides. Mortgages. Best of. Compare.

Calculators. Read & learn. Loans. Personal. Small business.

Student. Auto. Insurance.

Auto. Life. Money. Managing Money. Ways to save. Making money. Life events.

Travel. Travel. Best of.

Reviews. Popular tools.

Guides. Investing in stocks is an excellent way to grow wealth. But how do you actually start? Follow the steps below to learn how to invest in the stock market.

Select your investing style There are several ways to approach stock investing. Choose the option below that best represents your situation:. “I’m the DIY type and am interested in choosing stocks and stock funds for myself.” Keep reading; this article breaks down things hands-on investors need to know. Or, if you already know the stock-buying game and just need a brokerage, see our round-up of the. “I know stocks can be a great investment, but I’d like someone to manage the process for me.” You may be a good candidate for a robo-advisor, a service that offers low-cost investment management.

Virtually all of the major brokerage firms offers these services today, which invest your money for you based on your specific goals. Once you have a preference in mind, you’re ready to shop for an account.

Open an account Generally speaking, to invest in stocks, you need an investment account. For the hands-on types, this usually means a brokerage account.

For those who would like a little help, opening an account through a robo-advisor is a sensible option. We break down both processes below. Worth noting: A 401(k) is a type of investment account, and if you’re participating in one, you may already be invested in stocks, likely through mutual funds.

However, a 401(k) won’t offer you access to individual stocks, and your choice in mutual funds will likely be quite limited. Employer matching dollars make it worth contributing despite a limited investment selection, but once you’re contributing enough to earn that match, you can consider investing through other accounts. The DIY option: Opening a brokerage account An online brokerage account likely offers your quickest and least expensive path to buying stocks, funds and a variety of other investments. With a broker, you can open an individual retirement account, also known as an IRA — here are our — or you can open a taxable brokerage account if you’re already saving adequately for retirement elsewhere. We have a step-by-step if you need a deep dive. You’ll want to evaluate brokers based on factors like costs (trading commissions, account fees), investment selection (look for a good selection of commission-free ETFs if you favor funds) and investor research and tools. Below are two strong options from our analysis of the best online stock brokers: (a top pick in the low cost category) and (a top pick in the research category that also happens to have no account minimum). Cons.

No commission-free ETFs. Minimum balance requirement for active trading platform. The passive option: Opening a robo-advisor account A robo-advisor offers the benefits of stock investing, but doesn’t require its owner to do the legwork required to pick individual investments. Robo-advisor services will ask you about your investing goals during the on-boarding process and then build you a portfolio designed to achieve those aims. This may sound expensive, but the management fees here are generally a fraction of the cost of what a human investment manager would charge. For this most robo-advisors charge just 0.25% to 0.50% of your assets under management. And yes — you can also get an IRA at a robo-advisor if you wish.

As a bonus, if you open a robo-advisor, you probably needn’t read further in this article — the rest is just for those DIY types. Here are the two overall winners from NerdWallet’s latest robo-advisor comparison:.